Interview with Boris Gerjovič, M.A., MBA

"Elementum Industry Solutions (EIS) sees the difficulties of raw material procurement differently and offers better solutions which are definitely more."

Since 2021, we are witnessing a global trend defined by rising prices of energy and industrial input raw materials - what do you think are the main reasons for this trend?

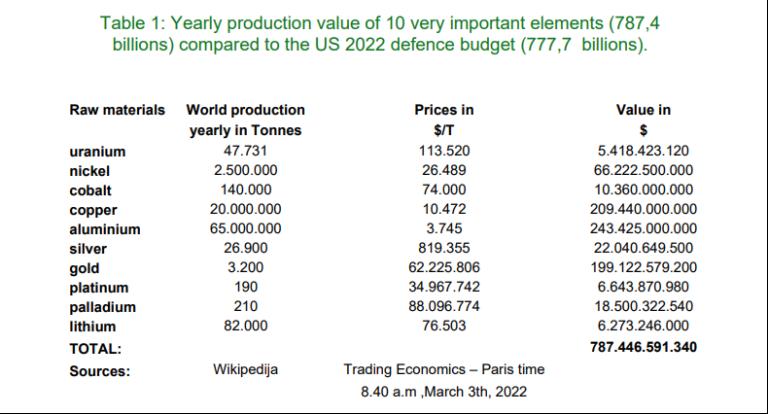

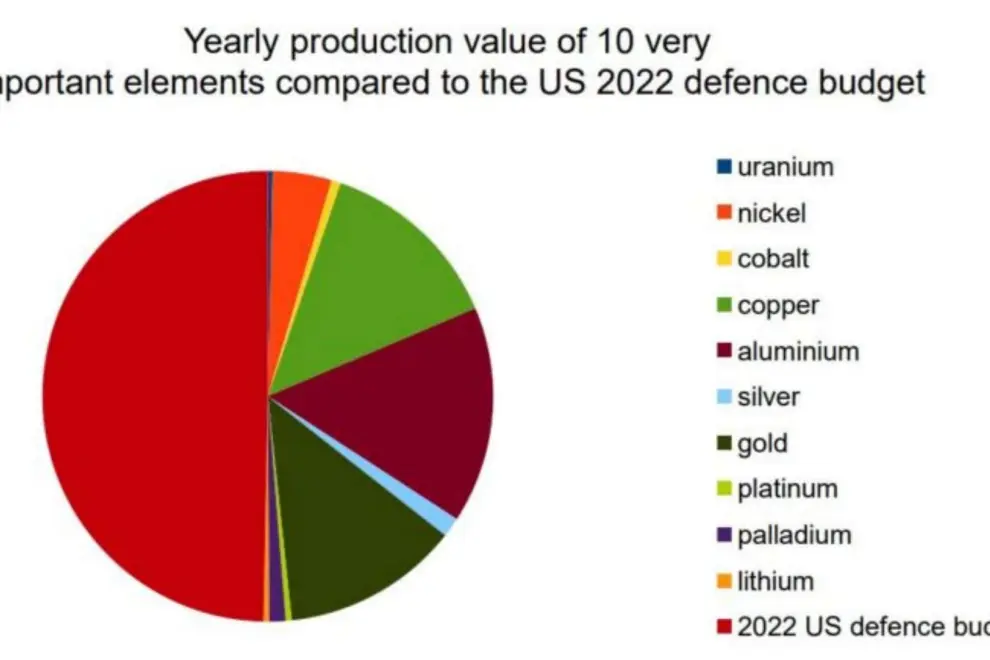

Media fairy tale story of the green revolution has brought exaggerations and over-expectations. Just as coronavirus vaccines are not 100 % efficient, it is also impossible to say that we will forget about fossil fuels and nuclear power plants, and live only from renewable sources from tomorrow on. This is especially true if we do not understand that this restructuring will entail a lot of problems and will unfortunately also be extremely long and expensive. The table below, however, actually shows who is the main culprit in these price increases.

The total value of the annual world production of all the elements listed below represents, in financial terms, the approximate equivalent of the annual consumption of just one army (US). I know that there are other expenditures in a military budget (such as salaries and logistics costs), and that the whole amount is not for armaments. What is absurd is the fact that the US would have significantly more power in the world if in only one year they would buy the whole production of all elements from this table instead of investing the same amount in the military.

On the other hand, such a wrong decision in US policy is also rather pleasing for us, because if they acted as I suggest, the prices of the elements in the table would literally skyrocket, only the military would carry less blame for inflation.

The list of raw materials whose prices are increasing is getting longer every day: copper, aluminium, nickel, cobalt, lithium, hydrogen, platinum, palladium, uranium, neodymium, silver, gold... what are your thoughts?

Maybe at the beginning it would be necessary to install about 50 tons of uranium in the nuclear power plant (Krško capacity), but from then on, the consumption would only be approx. 3 kg per day. What I mean to say is that there is no consumer in the civilian population who could cause an annual increase of more than 50 percent in the price of uranium which we had witnessed in 2021.Everything on the list is needed by the military, and unfortunately the military has the upper hand over everything (including new production technologies). So, when the most powerful armies in the world are in an arms race (and this is sadly more present now than ever before in our history), then the price of everything rises. The last element on the list that will see the price increase is the price of gold. This price then increases exponentially when a war really breaks out. The space industry is also booming. However, it uses practically the same input as the military, so it only adds fuel to the fire in terms of rising prices.

The classic explanation behind this is that lithium, cobalt and nickel can be found in batteries. Hydrogen represents an alternative solution to this. Copper reigns supreme in the electrical industry and if you want to set up 5,000 charging stations for electric vehicles in Paris, you would have to lay in the underground so much wire that the whole Paris later actually sleeps on copper. Silver consumption is growing with the solar power station market and it is similar with the neodymium consumption in the wind power plants market, but neodymium magnets are not present just in wind turbines - they are also used in cars.

It is also illusory to expect that in a certain period the price of copper would rise by 300% and that in the same period there would not be an increase in the price of aluminium which is also directly or indirectly used by the military industry..... Unfortunately, the civilian population has never before wondered how much copper there is in a military tank, in a military plane, in a nuclear submarine, etc... The answer: TOO MUCH!

As an expert, you are extremely critical of the so-called green revolution - can you explain your position?

I think it is enough to look again at the French documentary The Dark Side of Green Technologies. The documentary is probably still in the archives of TV SLO. Two months ago, this documentary was also broadcast by HRT. The greatest absurdity in itself is the fact that China produces 70% of all solar panels in the world - and then tells the whole world that at some point it cannot deliver them because it lacks coal to produce its own electricity. But the reality is that supplies from Russia to China in 2021 have increased by over 300% for both - coal and gas.

And what trend do you forecast in regard to input raw materials?

Personally, I believe that the time of so-called rare earths is essentially running out and that the upward trend in these prices will stop next year. What is important and what is missing in the aforementioned French documentary is the fact that larger vans, tanks, trucks, ships, trains, and planes will not run on batteries for the rest of our lives. It is only a question of when hydrogen will be able to prevail in these areas and, objectively speaking hydrogen can serve later also as a fuel for passenger cars. There is virtually no clean energy production; each solution has its drawbacks. But the biggest advantage of hydrogen is that there are many ways of possible production and each country can organize it in its own way. In some countries they can do it from solar energy, in others from night production of hydroelectric power plants, another interesting option is from sea water. Personally, I like the option from the synthetic gas the most, which is of course not the cheapest, but if I mention that we get these same synthetic gases by waste gasification, then I hope you understand that I would like to solve two problems at once. If we also intend to produce hydrogen from solar energy, then I would recommend that we perform it in Africa and then we can ship liquefied hydrogen to Koper.

Where in all this chaos can we find the mission and power of Elementum and Elementum Industry Solutions?

We have an extensive network of contacts across the world. When it comes to the issue of market power, we are happy to turn to the Belgian multinational Umicore, which has been our partner in the silver and gold segment since the very beginning of Elementum in 2006. On the other hand, we also have a partner abroad with a smaller team, which over the years has proven its quality, especially through the speed that is so necessary due to the current logistical chaos and other problems that are occurring. Practice proves that we are also strong in the field of forecasting the prices of raw materials, where our focus will continue to be on precious and non-ferrous metals.

Who makes up the Elementum Industry Solutions (EIS) team at Elementum, what services do you offer in Slovenia, and where do your strength and mission lie?

Our team of experienced experts united in "Elementum Industry Solution Elementum Industry Solutions - Elementum - definitely more" consists of: company director Peter Slapšak, Boris Gerjovič, M.A. - strategic and investment consultant, Pavel Rihtaršič - consultant for precious metals and rare earths, Bogdan Kukovec - business manager and EIS program manager.

This team of experts can offer you consulting services (Consulting and Forecasting), education services, and a comprehensive supply of precious metals and rare earths.

In these extremely challenges times, we provide the possibility of reliable, fast, and competitive deliveries for the needs of the Slovenian industry.

Elementum is a member of the ZNS (Purchasing Association of Slovenia), the Chamber of Commerce and Industry of Slovenia - Electronic and Electrical Engineering Association, and a member of the German-Slovenian Chamber of Commerce. As a socially responsible company, we are a partner of the Firefighting Association of Slovenia and a Bronze Partner of the Olympic Committee of Slovenia.

Answered by: Boris Gerjovič, M.A., MBA - Strategic and Investment Advisor, Elementum

Interviewer: B. Krajnik